New Zealand's Currency and Payment Options

Sample meta description.

Understanding New Zealand's Currency: The Kiwi Dollar (NZD)

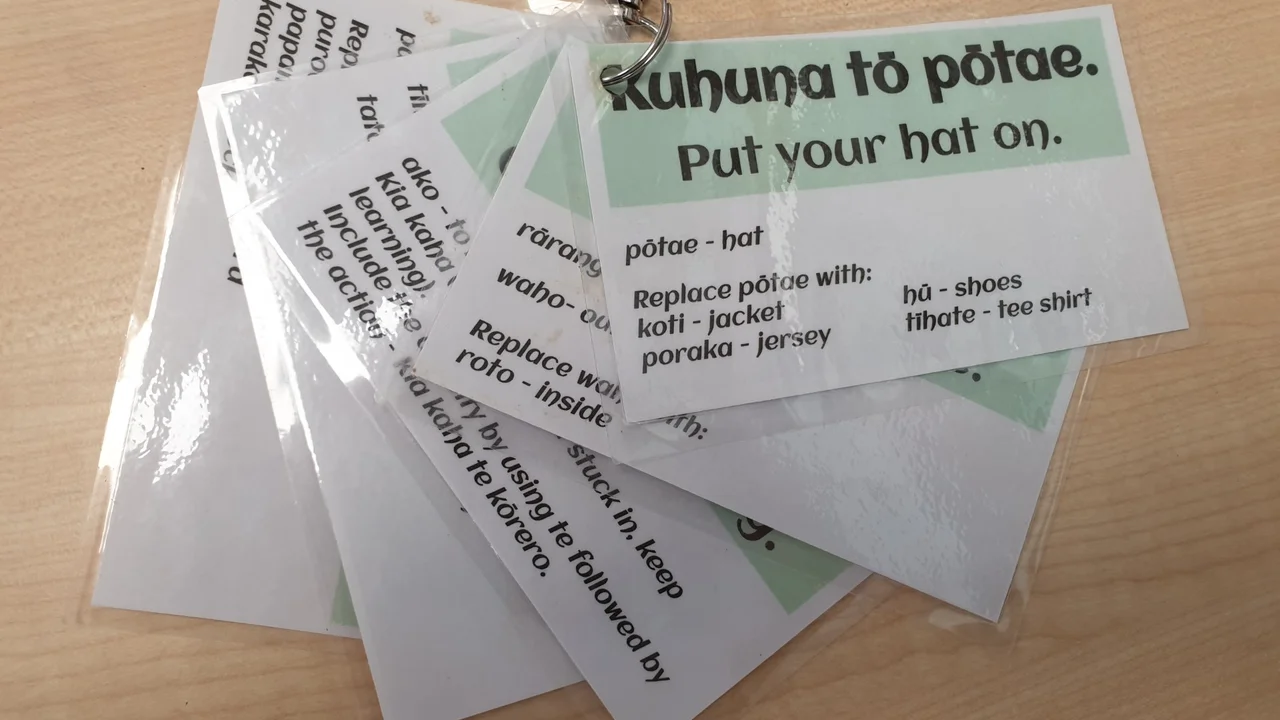

So, you're planning your epic New Zealand adventure? Awesome! One of the first things you'll need to wrap your head around is the local moolah – the New Zealand Dollar, often referred to as the Kiwi Dollar (NZD). It's what makes the world go 'round here, and knowing how to handle it is key to a smooth trip. You'll see it abbreviated as NZD or just with the dollar sign, $, like back home (assuming you're coming from a dollar-using country, of course!).

The Kiwi Dollar comes in both notes and coins. Notes are available in denominations of $5, $10, $20, $50, and $100. They are brightly colored and feature iconic New Zealand figures and landscapes. The coins are $1, $2, 50c, 20c, and 10c. You won't find 1c or 5c coins anymore; they were phased out a while back.

Getting familiar with the look and feel of the currency is a good idea. Before you leave home, you can check online for images of the notes and coins. That way, you'll be less likely to be caught off guard or, worse, scammed.

Cash vs. Card: Choosing the Right Payment Method in New Zealand

Alright, let's talk about how you'll actually pay for things. New Zealand is pretty modern when it comes to payment options. You'll find that credit cards and debit cards are widely accepted, especially in tourist areas and larger cities. But cash still has its place, particularly in smaller towns or for smaller purchases.

Credit Cards: Visa and Mastercard are the most commonly accepted credit cards in New Zealand. American Express is accepted in many places, but not everywhere, so it's always a good idea to have a backup. Discover is less common. Before you travel, let your credit card company know you'll be using your card in New Zealand. This helps prevent your card from being flagged for suspicious activity and potentially blocked. Also, check your card's foreign transaction fees. Some cards charge a fee for every purchase made in a foreign currency, which can add up quickly. Consider getting a travel credit card that waives these fees.

Debit Cards: Debit cards are also widely accepted, especially those with Visa or Mastercard logos. Just like with credit cards, inform your bank of your travel plans and check for any foreign transaction fees. Be aware that some merchants may require a credit card for certain transactions, such as renting a car or booking a hotel room.

Cash: While cards are convenient, it's always a good idea to have some cash on hand. You might need it for smaller purchases at markets, cafes, or in rural areas. Also, some smaller businesses may only accept cash. You can exchange currency at the airport, banks, or currency exchange bureaus. It's generally a good idea to compare exchange rates before you exchange your money to get the best deal. ATMs are widely available in New Zealand, so you can also withdraw cash as needed. Just be aware that your bank may charge fees for using foreign ATMs.

Exchanging Currency: Finding the Best Exchange Rates in New Zealand

So, where should you exchange your money? You've got a few options, each with its own pros and cons.

Airports: Airport currency exchange booths are convenient, but they typically offer the worst exchange rates. They know you're a captive audience, so they can get away with charging higher fees and offering less favorable rates. It's best to avoid exchanging large amounts of money at the airport.

Banks: Banks generally offer better exchange rates than airports. However, they may charge a commission fee for the transaction. It's a good idea to check with your bank before you travel to see what their exchange rates and fees are.

Currency Exchange Bureaus: Currency exchange bureaus, like Travelex or No1 Currency, can offer competitive exchange rates. It's worth comparing rates from different bureaus to find the best deal. Some bureaus may also offer online ordering, allowing you to lock in an exchange rate before you travel.

ATMs: Withdrawing cash from ATMs is often the most convenient and cost-effective way to get local currency. However, your bank may charge fees for using foreign ATMs. It's a good idea to check with your bank before you travel to see what their fees are. Also, be aware that some ATMs may charge their own fees, so check the screen carefully before you withdraw any money.

Online Currency Exchange: Services like Wise (formerly TransferWise) and Revolut offer competitive exchange rates and low fees. You can transfer money online and pick it up at a local branch or have it delivered to your hotel. These services are often a good option if you need to exchange a large amount of money.

Navigating EFTPOS: New Zealand's Electronic Payment System

EFTPOS (Electronic Funds Transfer at Point of Sale) is a super common way to pay for things in New Zealand. It’s essentially a debit card system, but it's so ingrained in the culture that even small businesses use it. You'll see EFTPOS terminals everywhere, from supermarkets to cafes to petrol stations.

Using EFTPOS is pretty straightforward. Just insert your debit card into the terminal, enter your PIN, and select the "savings" or "cheque" account option. The money will be deducted directly from your account. Most EFTPOS terminals also accept contactless payments, like Apple Pay and Google Pay.

One thing to keep in mind is that some smaller businesses may charge a small fee for using EFTPOS, especially if you're using a credit card. This is usually a small percentage of the total purchase, but it's always a good idea to ask before you pay.

Tipping in New Zealand: What's the Etiquette?

Tipping isn't as common in New Zealand as it is in some other countries, like the United States. It's not expected, and service staff are generally paid a decent wage. However, tipping is always appreciated for exceptional service.

In restaurants, it's customary to tip around 10% for outstanding service. You can also round up the bill to the nearest dollar or two. Tipping is not expected in cafes, bars, or for taxi rides. However, if you feel like the service was exceptional, you can always leave a small tip.

Ultimately, whether or not you tip is up to you. If you're happy with the service, a small tip is a nice gesture. But don't feel obligated to tip if you don't want to.

Travel Money Cards: A Convenient Option for International Travelers

Travel money cards are prepaid debit cards that you can load with foreign currency. They can be a convenient option for international travelers, as they allow you to lock in an exchange rate before you travel and avoid foreign transaction fees.

How They Work: You load the card with your desired currency, and then you can use it to make purchases or withdraw cash from ATMs just like a regular debit card. The exchange rate is locked in when you load the card, so you don't have to worry about fluctuations in the exchange rate.

Benefits: Travel money cards can help you budget your trip, as you know exactly how much you've spent. They can also protect you from fraud, as you're not carrying large amounts of cash. And they can save you money on foreign transaction fees.

Drawbacks: Travel money cards typically charge fees for loading, unloading, and using the card. It's important to compare the fees charged by different cards before you choose one. Also, the exchange rates offered by travel money cards may not be as competitive as those offered by banks or currency exchange bureaus.

Product Recommendations:

- Wise (formerly TransferWise) Multi-Currency Account: Not strictly a travel card but offers excellent exchange rates and low fees for international transfers and spending. You get a debit card linked to your account. Great for holding multiple currencies. Fees are transparent and usually very low. Ideal for longer trips and frequent travelers. Costs vary depending on the currency and transfer amount, but are generally competitive.

- Revolut: Similar to Wise, Revolut offers a multi-currency account and a debit card. They provide competitive exchange rates and fee-free ATM withdrawals up to a certain limit. Good for everyday spending and managing your travel budget. Different subscription tiers offer varying benefits and fee structures. Worth checking out for short to medium-length trips. Free accounts are available, with paid tiers offering additional perks.

- Travelex Money Card: A dedicated travel card that allows you to load multiple currencies. Offers a physical card and a mobile app for managing your account. Convenient for locking in exchange rates before your trip. Fees can be higher than Wise or Revolut, so compare carefully. Suitable for travelers who prefer a dedicated travel card. Fees vary depending on the currency and card type.

Comparison Table:

| Feature | Wise | Revolut | Travelex Money Card |

|---|---|---|---|

| Exchange Rates | Excellent (mid-market rate) | Excellent (interbank rate) | Variable (can be less competitive) |

| Fees | Low and transparent | Varies by plan, can be low | Can be higher, check carefully |

| Multi-Currency Support | Yes | Yes | Yes |

| ATM Withdrawals | Low fees | Fee-free up to a limit | Fees apply |

| Best For | Long trips, frequent travelers | Everyday spending, budget management | Travelers who prefer a dedicated card |

Protecting Your Money: Tips for Avoiding Scams and Fraud

Unfortunately, scams and fraud can happen anywhere, including New Zealand. It's important to be aware of the risks and take steps to protect your money.

Be wary of unsolicited emails or phone calls: Never give out your personal or financial information to anyone you don't know. Be especially careful of emails or phone calls that ask you to provide your credit card number, bank account number, or password.

Use secure websites: When making online purchases, make sure the website is secure. Look for the padlock icon in the address bar and make sure the website address starts with "https."

Protect your PIN: Never share your PIN with anyone. When using an ATM, cover the keypad with your hand to prevent others from seeing your PIN.

Monitor your accounts: Regularly check your bank and credit card statements for any unauthorized transactions. If you see anything suspicious, report it to your bank or credit card company immediately.

Be careful of scams: Be aware of common scams, such as phishing scams, lottery scams, and investment scams. If something sounds too good to be true, it probably is.

Report any suspicious activity: If you suspect you've been scammed or have been a victim of fraud, report it to the police and your bank or credit card company immediately.

Budgeting Your Trip: Estimating Daily Expenses in New Zealand

Knowing how much things cost is crucial for planning your budget. New Zealand can be a pricey destination, especially if you're indulging in a lot of activities and eating out frequently.

Accommodation: Budget accommodation (hostels, campsites) can cost around NZ$30-50 per night. Mid-range hotels and motels range from NZ$100-200 per night. Luxury hotels can cost NZ$300 or more per night.

Food: Eating out can be expensive. A meal at a casual restaurant can cost around NZ$20-30 per person. A meal at a fine-dining restaurant can cost NZ$50 or more per person. Groceries are reasonably priced, so cooking your own meals can save you money.

Transportation: Renting a car is a popular way to get around New Zealand, but it can be expensive. Rental cars typically cost around NZ$50-100 per day. Public transportation is available in major cities, but it can be limited in rural areas. Bus passes are a good option for budget travelers.

Activities: Activities can range from free (hiking, swimming) to very expensive (skydiving, helicopter tours). Budget for activities that are important to you and look for deals and discounts.

Sample Daily Budgets:

- Budget Traveler: NZ$80-120 per day (hostel accommodation, cooking own meals, using public transport, free activities).

- Mid-Range Traveler: NZ$150-250 per day (motel accommodation, eating out occasionally, renting a car, some paid activities).

- Luxury Traveler: NZ$300+ per day (luxury hotel accommodation, eating out at fine-dining restaurants, renting a premium car, doing expensive activities).

Staying Connected: Using Mobile Payment Options in New Zealand

Staying connected is essential for many travelers, and New Zealand offers several mobile payment options that can make your trip easier.

Contactless Payments: As mentioned earlier, contactless payments are widely accepted in New Zealand. You can use Apple Pay, Google Pay, or Samsung Pay to make purchases at most merchants.

Mobile Banking Apps: Most major banks in New Zealand have mobile banking apps that allow you to manage your accounts, transfer money, and make payments. These apps can be very convenient for managing your finances while you're traveling.

Prepaid SIM Cards: If you're planning to use your phone a lot while you're in New Zealand, consider purchasing a prepaid SIM card. This will give you access to local data and calling rates, which can be much cheaper than roaming charges. You can purchase prepaid SIM cards at the airport, convenience stores, and mobile phone stores.

Wi-Fi: Wi-Fi is widely available in New Zealand, especially in hotels, cafes, and restaurants. You can often access free Wi-Fi, but some places may charge a fee.

Emergency Funds: Planning for the Unexpected in New Zealand

It's always a good idea to have an emergency fund when you're traveling, just in case something unexpected happens.

How much to save: Aim to save at least NZ$500-1000 for emergencies. This should be enough to cover unexpected expenses, such as medical bills, car repairs, or accommodation costs.

Where to keep your emergency fund: Keep your emergency fund in a separate account from your regular spending money. This will help you avoid dipping into it unless you really need it.

How to access your emergency fund: Make sure you know how to access your emergency fund if you need it. You can keep it in a savings account, a travel money card, or even in cash.

What to do in an emergency: If you have an emergency, contact your insurance company, your embassy, and the local authorities. They can provide you with assistance and support.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)